corporate tax increase proposal

Ad Corporate Tax Tools and Services to Help Businesses Meet Global Tax Transformation. This is an increase from the current 21 to 28.

Tax Cuts And Jobs Act Tcja Taxedu Tax Foundation

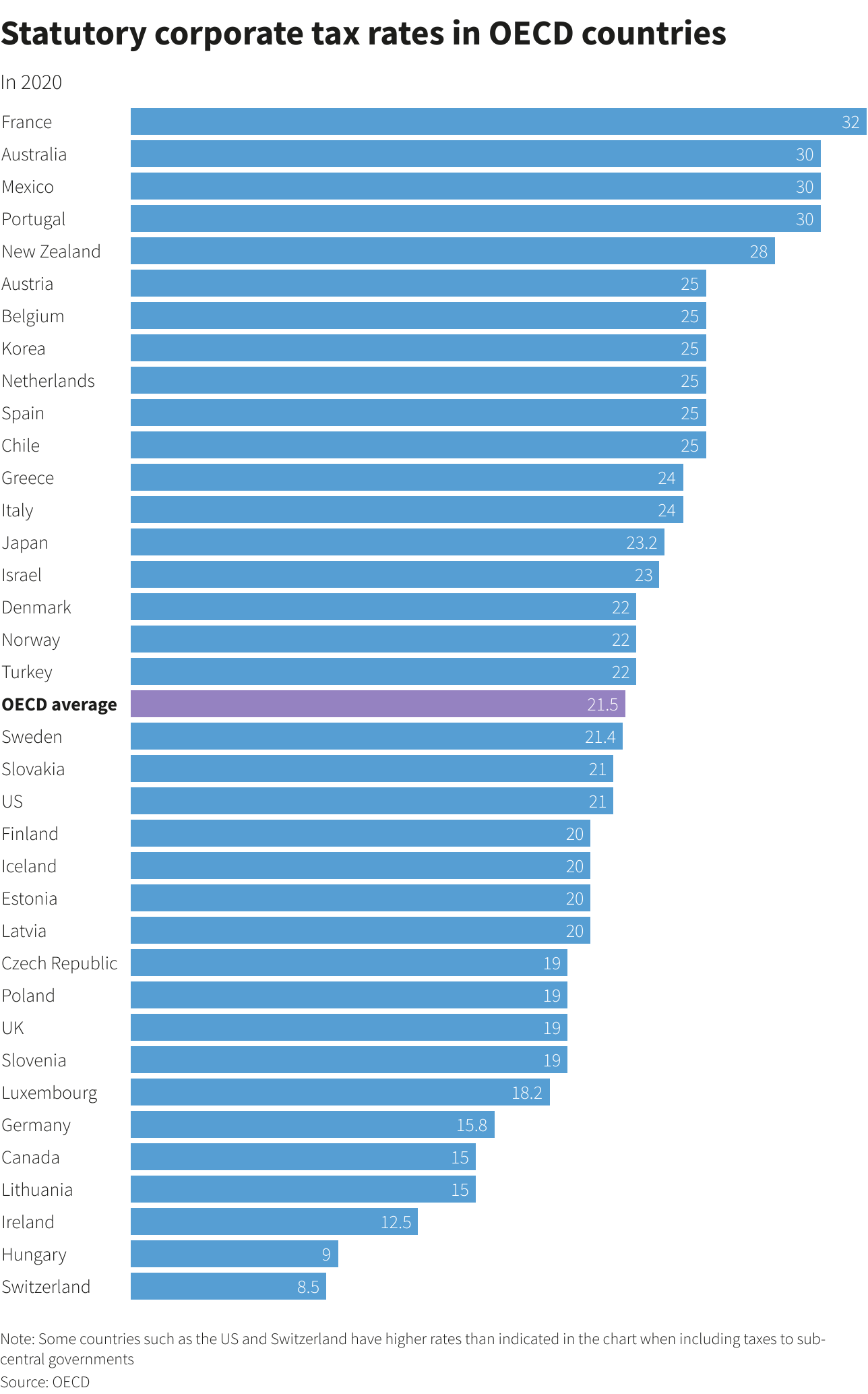

Rather than the 21 enjoyed by many businesses from the Tax Cuts.

. Corporate tax rate to 28 percent from 21 percent and a variety of changes to international tax law all meant to force companies to. Double the tax rate on GILTI and impose it country-by-country. This proposal issues two.

Raise the maximum corporate rate. February 24 2021. The proposed corporate profit minimum tax would add significantly to the complexity of corporate tax compliance and administration.

As a result of the corporation tax rate increase the full rate of 25 will be applicable to businesses making profits of over 250000. Corporate Tax Rate. The school board is scheduled to ratify.

Businesses earning profits between. The president laid out the tax hikes as part of his 58 trillion budget blueprint for federal spending in fiscal 2023 which begins in October. Democrats release details of corporate minimum tax proposal.

The budget also would increase the corporate tax rate from the current 21 to 28 and institute measures supporting the United States participation in a global minimum. The rate reached 12 in 1918 for corporate income over 2000. The 2022 Tax Plan proposes to increase the headline corporate income tax rate from 25 to 258 for fiscal year FY 2022 and onwards.

Several 2020 corporate tax plans have been proposed including increasing the corporate tax rate. Ad The 1 Alternative to the Corporate Tax Rate Heats Up. In a 2017 report.

787 million tax increase. President Bidens administration has made a proposal to increase the corporate tax rate. Corporate Tax Rate Increase.

In addition to a proposal to. This is estimated to raise 13. May 20SELINSGROVE Taxes will rise by 1 mill in the Selinsgrove Area School District under a proposed 475 million spending plan.

Biden says will raise about 1t and that it will still be much lower than the 35 in 2017. Learn What EY Can Do For You. The proposed increase would reverse the improvements enacted in the TCJA which brought the US.

History of the Corporate Tax Rate. DANVILLE School director Wayne Brookhart Monday night floated the idea of not increasing property. Well Guide You Through Every Step.

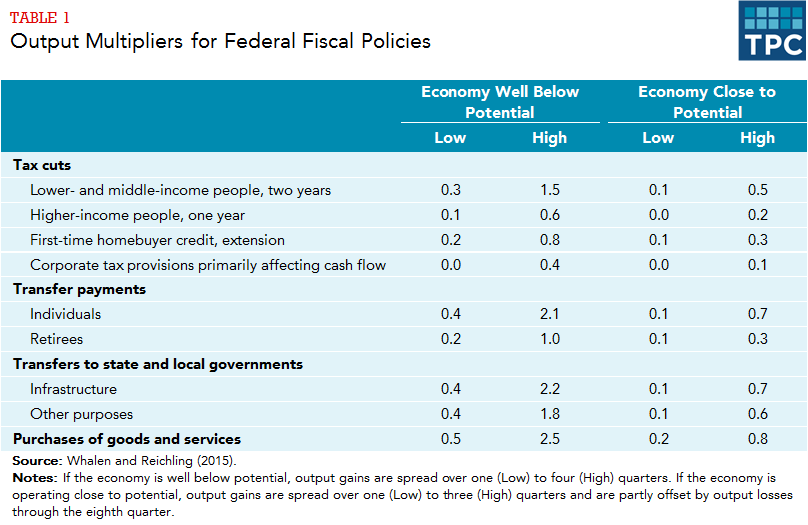

The 1 Alternative to the US. Establish a corporate minimum tax on book income. In addition a corporate tax increase will harm workers in the form of lower wages and fewer jobs.

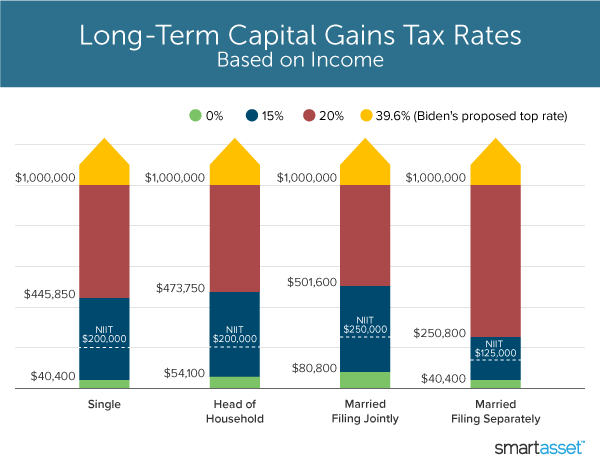

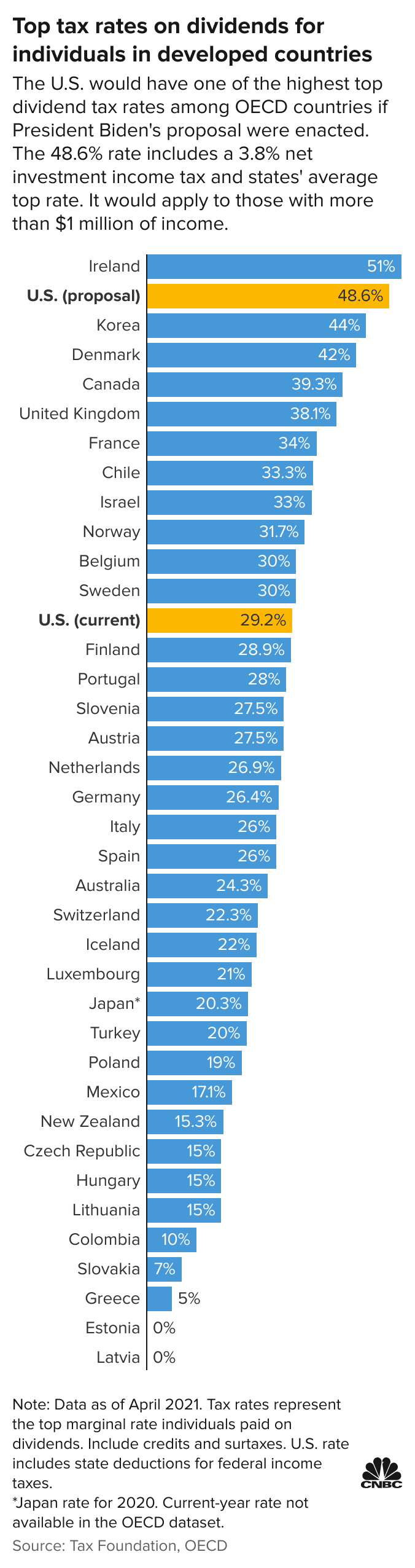

The proposal includes top. Bidens proposal includes raising the US. Raises about 191b per year according.

28 corporate rate. The effect of each of these proposals will be to increase the cost of capital. Increase the corporate income tax to 28.

This is a cornerstone of the proposed tax increases. The first corporate taxes were levied in 1909 at a rate of 1. WASHINGTON New details of a Democratic plan to enact a 15 minimum corporate tax on declared income.

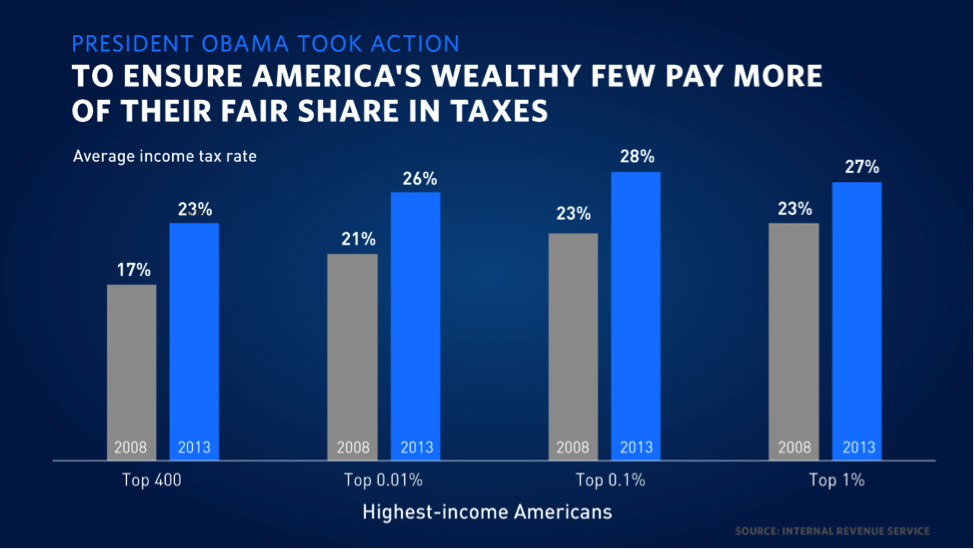

President Bidens proposal to raise the corporate tax rate to 28 percent reversing only part of the 2017 rate cut would help make the tax code more progressive and help. The December 2017 tax reform law lowered the. 396 top individual rate.

Corporate Tax Rate Heats Up - Order Online Today. The Ways and Means Committee Subtitle I would increase the corporate tax rate from the current federal rate of 21 percent to 265 percent. Companies with profits between 50000 and 250000 will pay tax at the main rate reduced by a marginal relief providing a gradual increase in the effective Corporation Tax.

Corporate rate down to closer to the OECD average although the. Learn What EY Can Do For You. House Democrats outlined tax increases they aim to use to offset up to 35 trillion in spending on the social safety net and climate policy.

Scalable Tax Services and Solutions from EY. President Biden and congressional policymakers have proposed several changes to the corporate income tax including raising the rate from 21. Ad Corporate Tax Tools and Services to Help Businesses Meet Global Tax Transformation.

Scalable Tax Services and Solutions from EY. At least seven Democratic presidential candidates have proposed raising the corporate income tax rate this primary season. Democratic presidential candidate Joe Biden has promised not to raise taxes on anyone making less than 400000 a year but his proposal to raise the corporate tax rate from.

Under his proposal taxes would rise.

Biden Banks On 3 6 Trillion Tax Hike On The Rich And Corporations The New York Times

Corporate Tax Reform In The Wake Of The Pandemic Itep

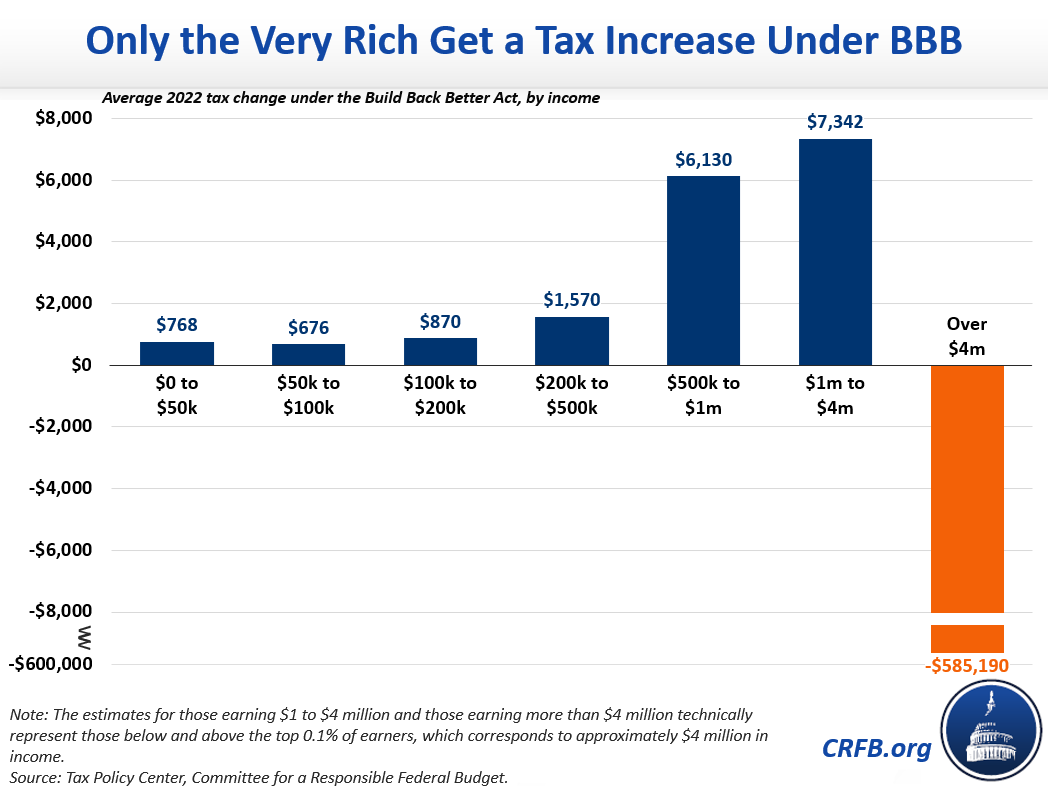

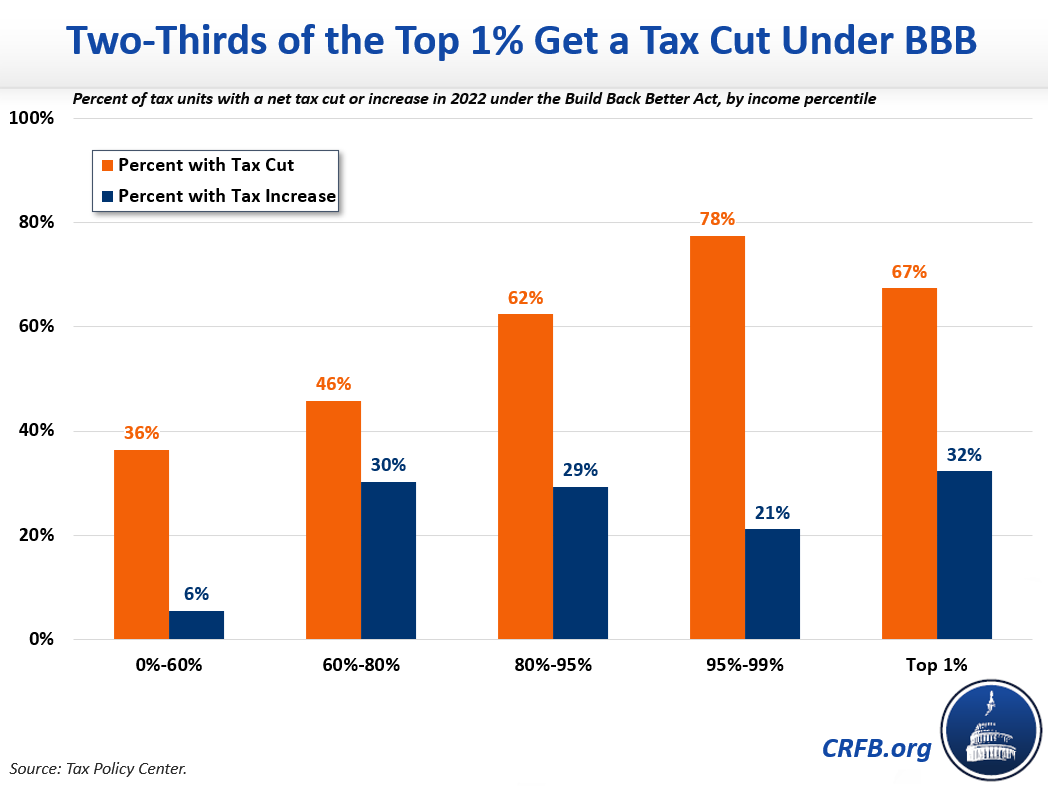

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Individual And Corporate Tax Reform

Corporate Income Tax Definition Taxedu Tax Foundation

Countries Agree With Plan To Set Minimum Corporate Tax Rate World Economic Forum

Us Offers New Plan In Global Corporate Tax Talks Financial Times

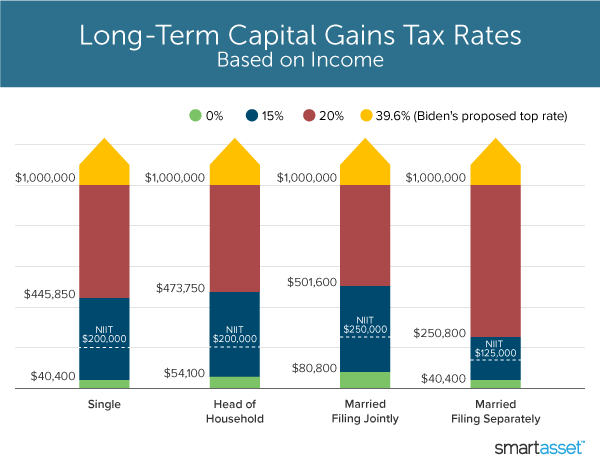

What S In Biden S Capital Gains Tax Plan Smartasset

New State By State Analysis Of Gop Tax Hike Plan Crushing Tax Increases For Families Across America Speaker Nancy Pelosi

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

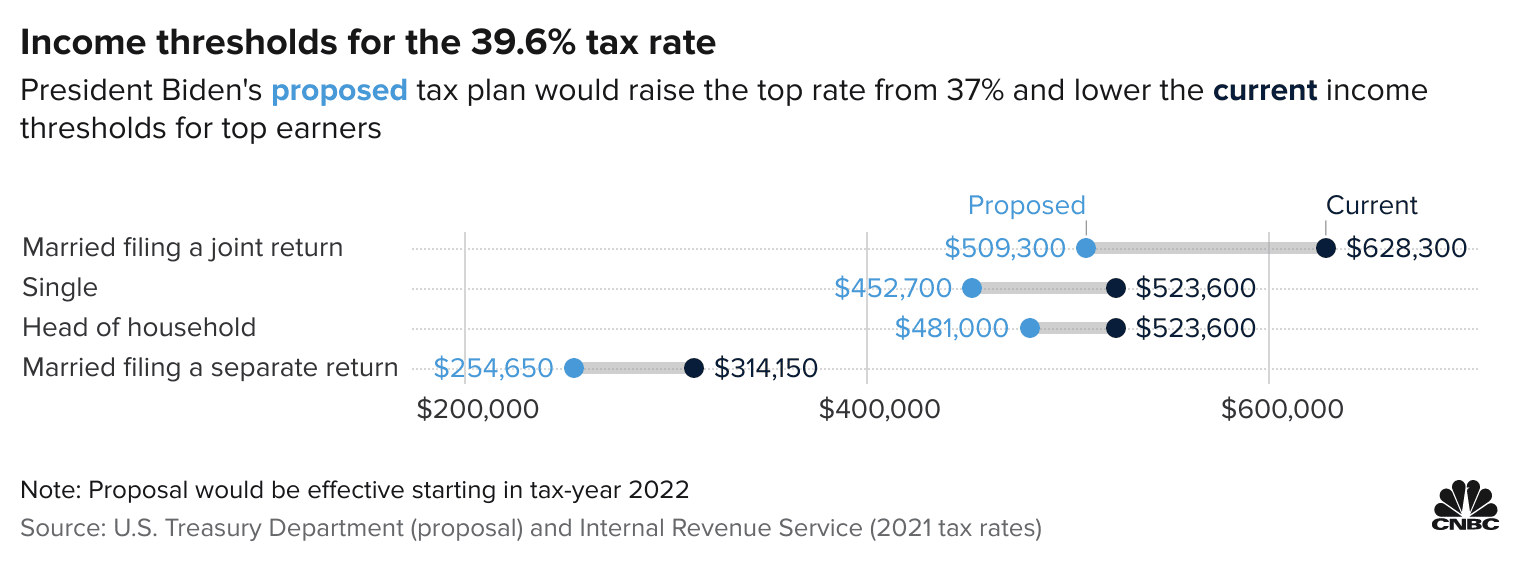

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Two Thirds Of The One Percent Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)